Contrasting Pricing Strategies of Self-Storage Providers

At Veritec Solutions, we routinely collect web-based pricing data from over 1,500 self-storage companies in the United States. The number of stores in these companies range from one to over 2,000. So, what are some of the insights that these data provide? Do we see contrasting pricing strategies by these companies? If so, how are these strategies different?

Let’s look at ten of the larger operators. We’ll focus on their pricing activity for unit groups displayed on their websites for at least 300 days in 2018. That is, operators rarely sold out these mostly available unit groups.

Furthermore, we’ll restrict our analysis to unit types between 25 and 300 square feet in size. For example, a unit type might be the 10’ x 10’, ground floor, climate-controlled units at a given store. The average number of unit types per store ranged from six to over 30. For each of the ten companies, prices were obtained from more than 100 stores.

So how many times did Operators change their prices?

The figure below shows two things. First, it shows the average number of times each company changed the prices of its unit types. Second, the figure shows the maximum number of price changes made for any unit type. The data from these 10 companies suggest that large self-storage operators implement a wide range of contrasting pricing strategies.

For example, Company E changed the price of a unit type an average of 18.1 times in 2018. The most price changes that E made for any of its unit types was 33. Companies A, B and C rarely changed prices. On the other hand, I and J typically changed their unit type prices about every week or even more. For some unit types, Company J changed its move-in price as frequently as four to five times per week. For some unit types, Company J changed prices more than 210 times during the year!

How big were the price changes?

When we look at the typical size of the price changes made by these companies, we also see significant and rather interesting differences. The figure below shows the average percentage price change for each company.

The average price change ranged from four to 11 percent across the 10 companies. Companies D and G changed their prices by the smallest amounts, whereas F and I changed by the largest.

Based on the average price changes these companies made, their strategies and tactics may not seem too different. After all, the average price change for a $100/month rental ranged from about $4 to $11. They are certainly different, but perhaps not dramatically so. As might be expected, price change percentages tended to be higher for lower priced unit types. However, the difference was still relatively small.

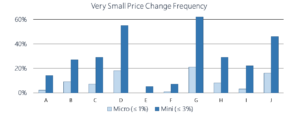

Upon closer inspection, however, their strategy differences become more apparent, particularly in the companies’ pricing tactics. The next figure highlights how often each company makes a “micro” price change of less than 1% as well as a “mini” change of less than 3%. Yes, that means a “mini” price change is $3 or less for a $100/month rental, and “micro” for $1 or less!

Companies D, G, and J made many small price changes. When G changed the move-in price on a unit type, the price was a mini change (3% or less) about 60% of the time. 21% of the price changes made by G were micro (1% or less) ones. Conversely, when Company I changed the price of a unit type, mini price changes were made only 22% of the time. Only 3% of the changes were micro ones.

No one strategy, by itself, is right or wrong, better or worse. Rather, it’s what is most appropriate for your situation.

There may be no single “silver bullet” pricing strategy that is right for all companies and all their stores. You may be faced with competitors that implement very different, contrasting pricing strategies and tactics. Therefore, it is important that you at least understand your competitors’ tactics. This includes knowing how frequently they change their prices and by how much.

In our work with a variety of self-storage companies, we are finding that more and more operators are becoming more systematic with incorporating competitor prices into their own pricing tactics to help ensure their competitiveness.

For more information, see Dr. Warren Lieberman’s article “Different Pricing Strokes for Different Folks” published in the Summer 2019 issue of THE KEYSTORE, the The Official Newsletter of the Pennsylvania Self Storage Association (PASSA).